In 2025, saving money is no longer just about opening a traditional bank account or stashing away funds manually. With the rise of financial technology (fintech), savings apps have transformed how people manage their money, automate deposits, earn higher interest, and stay disciplined with their financial goals. These apps combine security with convenience, making them perfect for both beginners and experienced savers. In this article, we’ll explore the top 10 savings apps in 2025 that can help you grow your wealth safely and effectively.

1. Acorns 2025 Edition

Acorns continues to evolve in 2025 with even smarter algorithms that round up spare change from every purchase and automatically invest it into diversified portfolios.

The app now includes enhanced sustainability portfolios, giving users the option to align savings with environmentally conscious investments. Acorns has also boosted security with biometric login and real-time fraud alerts.

Why it stands out: It makes saving effortless for people who struggle to set money aside manually, while also introducing them to investing.

2. Chime Save & Grow

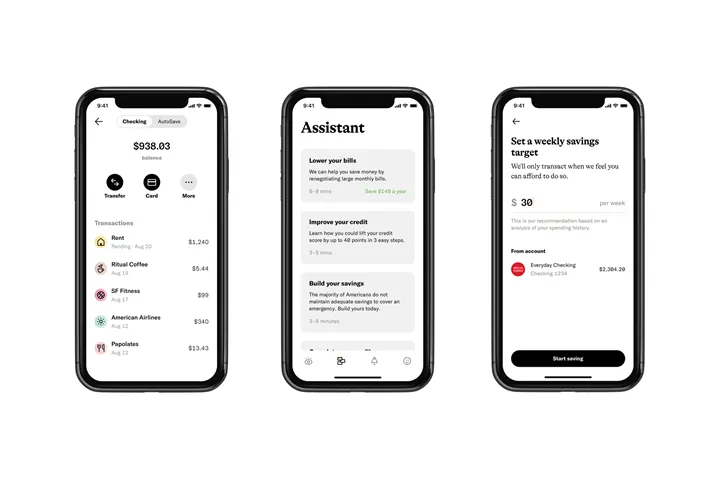

Chime has established itself as a top challenger bank, and in 2025 its Save & Grow feature has become a leading savings tool.

The app offers automated transfers every time a user gets paid, alongside competitive interest rates that outshine many traditional banks. Chime also has instant transaction notifications and overdraft protection, ensuring financial stability.

Why it stands out: Chime blends savings with day-to-day banking, making it seamless to save without moving money across different platforms.

3. Qapital Smart Goals

Qapital has always been known for goal-based saving, and in 2025 it introduces AI-powered rules that help users save smarter.

From automatically saving when you achieve fitness goals to stashing cash every time you order takeout, Qapital creates fun and personalized ways to save. With added integration with wearable tech, the app gamifies saving like never before.

Why it stands out: It turns saving into an engaging, customizable experience that feels less like a chore and more like a reward.

4. Digit AI Saver

Digit has built its reputation on using AI to analyze spending habits and automatically move small amounts into savings.

In 2025, its upgraded AI engine offers hyper-personalized savings plans. For example, it can predict future expenses like holiday shopping or vacations and ensure you’re financially prepared. Digit also offers FDIC-insured accounts with robust security measures.

Why it stands out: Its predictive AI ensures that saving fits naturally into your lifestyle without disrupting essential spending.

5. Yotta Savings

Yotta redefines saving by combining it with lottery-style rewards. The more you save, the more tickets you get for weekly prize draws.

In 2025, Yotta has introduced crypto-linked savings options, allowing users to earn rewards in both cash and digital assets. Security remains a priority with insured accounts and secure blockchain integration.

Why it stands out: It motivates people to save by gamifying the process with fun prize incentives.

6. Ally Bank App

Ally Bank has remained a strong player in online banking, and its app continues to excel in 2025.

The app offers high-yield savings accounts with easy transfers, budgeting tools, and 24/7 customer support. Ally has also introduced AI chat assistants that provide real-time financial advice, helping users maximize their savings.

Why it stands out: It’s a trusted, full-service bank with consistently high savings rates and excellent digital tools.

7. SoFi Save & Invest

SoFi blends savings with investing in 2025, offering both high-yield savings accounts and automatic investing options.

The app includes features like round-ups, cash-back on purchases, and free access to financial planners. With strong security infrastructure, SoFi ensures user data and money remain safe.

Why it stands out: It’s ideal for people who want a one-stop shop for saving, investing, and planning for bigger financial goals.

8. Betterment Cash Reserve

Betterment has long been a leader in robo-advising, and its Cash Reserve account in 2025 is a top savings tool.

It offers very competitive interest rates, automated transfers, and seamless integration with Betterment’s investment accounts. AI-driven advice helps users decide how much to save versus invest, based on risk tolerance and financial milestones.

Why it stands out: It bridges the gap between short-term saving and long-term investing with ease.

9. Greenlight for Families

Greenlight is primarily known for helping parents teach kids about money, but in 2025 its savings app is more powerful than ever.

Families can now set shared savings goals, such as vacations or college funds, with real-time progress tracking. The app provides robust parental controls and financial literacy tools for kids.

Why it stands out: It’s perfect for families who want to save together while teaching children lifelong money habits.

10. Empower Finance

Empower combines budgeting, savings, and personalized coaching. In 2025, it has become a go-to app for people seeking a well-rounded money management tool.

It offers automatic savings plans, personalized recommendations, and even cash advances when needed. With secure banking infrastructure, users can trust that their money is safe.

Why it stands out: It balances savings with financial flexibility, giving users a holistic way to manage their money.

Conclusion

In 2025, savings apps are smarter, safer, and more engaging than ever before. Whether you’re someone who struggles to save, a family teaching kids about money, or a professional looking for higher returns, there’s a savings app designed for your needs. From Acorns’ effortless micro-investments to Greenlight’s family-focused savings goals, these apps prove that the future of personal finance is both secure and empowering. By choosing the right app, you can automate your savings journey, grow your wealth, and achieve your financial goals with confidence.